Top Small Business Government Contractors

Who are the top companies winning small business contracts?

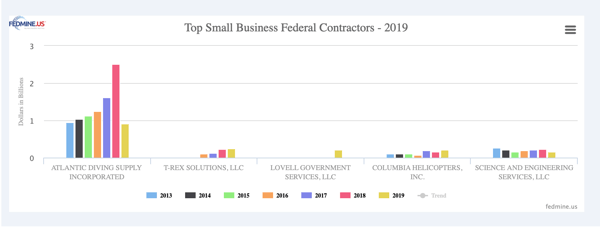

As of 5/6/2019 more than 60k companies have a won a slice of the $42B dollars of small business contracts. The top contractor, Atlantic Diving Supply Incorporated, won more than $918M YTD for FY 19 and is also the top contractor winning small business contracts for FY 2018 ($2.5B) and FY 2017 ($1.6B). FY 2019 has T-Rex Solutions in second place at $242M - a big difference between the two! Lovell Government Services, a verified veteran owned business is in third place with $219M.

Of the top 60 companies our heartiest congratulations to the 9 Verified Veteran Owned Businesses on this list, most of which are located in the DC Metro area. (click on the image above for a list of the top 61 companies).

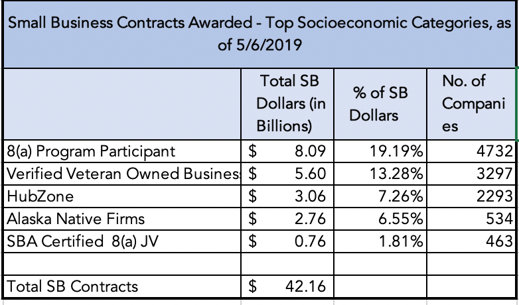

A quick socioeconomic analysis of the firms shows that while 8(a) Program Participant firms account for almost 20% of the small business dollars the Verified Veteran Owned Businesses account for 13.2% YTD and a small number of Alaskan Native Companies account for 6.55%!

Do keep in mind that a company could have more than one socioeconomic designation, so an Alaska Native Firm could be an 8(a) and a HubZone.

Do keep in mind that a company could have more than one socioeconomic designation, so an Alaska Native Firm could be an 8(a) and a HubZone.

I ran a few searches in Fedmine and found many transactions awarded to large businesses that were classified as small business contracts - am I surprised? Not really, but I should be! Here's an example, and this is where I have to think about how a large company can win a contract "only one source" when clearly there are many true small businesses that can perform the work that the contract was awarded for!

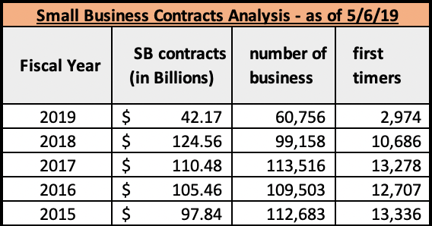

Have a look at this chart I put together:

When I look at this a few thoughts come to mind:

- - Small business contracts have gone up slightly over the past 4 years and yet as a % of total spend they struggle to be in the 20-25% range

- - The number of businesses winning these dollars have fallen from 2017 to 2018, and I am certain that a small part of it is attributable to consolidation, but a 12.6% decline is high

- - The number of first-timers has declined and that is a fall that we need to be aware of and address. Is it lack of knowledge for these companies or is it the fear of government contracting and support? How are agencies addressing this, apart from the SBA adding it to the annual scorecard.

The numbers make me think, and I believe that the small businesses need to be aware of the changing trends in federal contracting, specifically how they affect a small business. There are changes that are happening, initiatives such as strategic sourcing and category management, Section 809, changes in the GSA schedules, use of Best In Class Vehicles, and even Bids and Protests affect contracts, all of which affect small businesses.

Posts by Topic

- Federal Business Intelligence (27)

- federal spending (27)

- Federal Contract Spend (22)

- Contract Data (17)

- Federal Prime Contracting (16)

- government data (15)

- government contracts (14)

- Small Business Contracts (13)

- Federal Business Opportunities (12)

- federal government contracts (11)

- global pandemic (11)

- coronavirus (10)

- Covid 19 (9)

- covid federal spend (9)

- COVID (8)

- federal contracts (8)

- Federal Government Agencies (7)

- P20C (7)

- national interest action (7)

- ESRS (6)

- business intelligence tools (6)

- company information (6)

- covid 19 federal spend (6)

- federal prime contractors (6)

- subcontractor (6)

- government contracting (5)

- women owned small business (5)

- First-Timers (4)

- NASA SEWP V (4)

- competitive intelligence (4)

- prime contractor (4)

- real time data (4)

- wosb (4)

- GWAC (3)

- Size Standard (3)

- category management (3)

- federal agency (3)

- prime contractors (3)

- FY 2022 (2)

- agency plan (2)

- federal subcontract (2)

- government contract opportunities (2)

- government spending (2)

- subcontract awards (2)

- subcontracting (2)

- veteran owned firm (2)

- "black history (1)

- A/E/C (1)

- Federal Data Sources (1)

- HBCU (1)

- IIJA (1)

- Insider (1)

- NAICS (1)

- Oasis on-ramp (1)

- Others (1)

- REPORTS (1)

- SAM UEI (1)

- SAT (1)

- SBA (1)

- SDVOSB (1)

- Simplified Acquisition Procedure (1)

- Simplified Acquisition Threshold (1)

- Small Business Interest Groups (1)

- Small Business Program Officers (1)

- WVOSB (1)

- account plan (1)

- alliant 2 SB (1)

- aptac (1)

- big data (1)

- contracts during government shutdown (1)

- customer engagement (1)

- federal budget (1)

- government shutdown (1)

- how to get government contracts (1)

- hubzone (1)

- hurricane spending (1)

- joint ventures (1)

- oasis (1)

- ptac (1)

- shutdown (1)

- spending on emergency (1)

- subcontractors (1)

- teaming partner (1)

- top small business contractors (1)

- verified firm (1)

- veteran (1)